Charting the course for future enterprise software adoption

Navigating the successful adoption of new enterprise software is akin to orchestrating a transformation rather than just implementing a tool. Picture it as a journey, where a tailored strategy becomes your map for seamless navigation.

Read More...Turn the Petty Cash chaos around.

Ever found yourself wrestling with the complexities of petty cash management? Fear not, for our ERP system, Xebra®, is here to transform your financial struggles into victories! You know that feeling when petty cash becomes a puzzle, and you're left wonde

Read More...Less juggle, more success: Your business wingman at play

Xebra® is one such software that excels at giving you the advantages of managing your accounting, bookkeeping, payroll, and customer connections. With its user-friendly design and comprehensive capabilities, Xebra® enables MSMEs to efficiently manage thei

Read More...6 Invoicing secrets you wish you knew

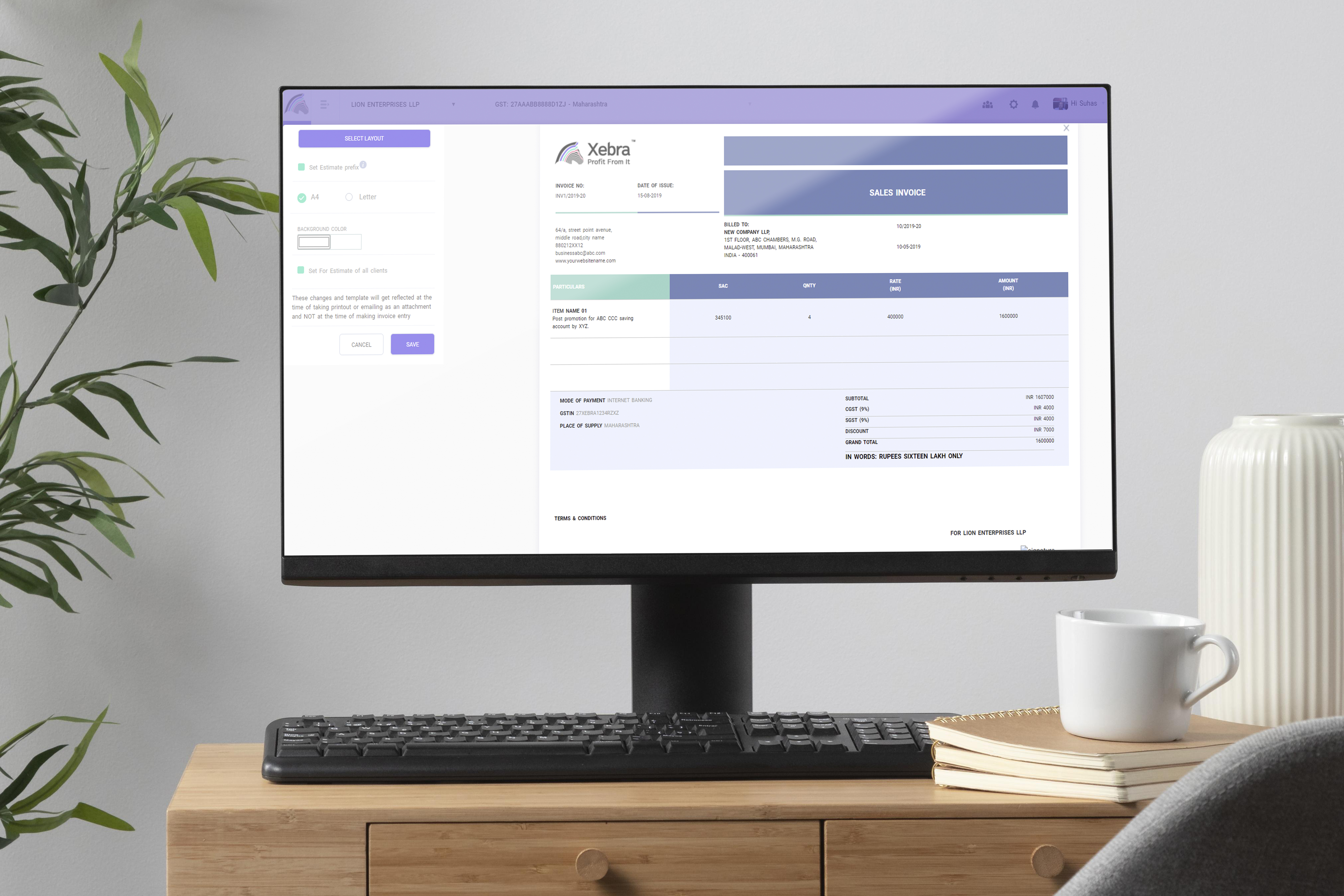

Xebra®, on the other hand, is the cream of the crop when it comes to invoicing software. It's like that dependable, experienced first mate you can always rely on. It's designed for small businesses like yours, with a user-friendly interface, mobility choic

Read More...Excel in payments, bookkeeping, and invoicing mastery

Allow us to reveal the ultimate game changer for your business: selecting the right online payment solution, handling bookkeeping like a pro, and slipping those invoices to your clients in style.

Read More...Your business's Sherlock Holmes: Unraveling the mystery of All-in-One solutions!

We're embarking on an exhilarating journey into the realm of ERP brilliance, guided by the wit, humour, and enchanting magic of Xebra®.

Read More...TDS asset mastery: Click, Win, Pay

Xebra® stands out as your go-to buddy for stress-free TDS management in a world where simplicity is a rare diamond. Say goodbye to tax-related difficulties and hello to a more efficient, simpler manner of managing your finances. Managing TDS has never been

Read More...Where billing glam meets a party vibe

Efficiency, customization that turns heads, and an invoice dance party await. Say hello to Xebra® magic, where your billing journey transforms into a legendary adventure!

Read More...Ditch the numbers crunch, dance with Xebra®

Say goodbye to billing headaches and hello to the sweet melody of automation, courtesy of Xebra®'s scalable, user-friendly, and cost-effective features. Imagine a future where saving money is as simple as a tap on your tablet, and your financial path becom

Read More...Navigating HR waters? Xebra's got the magic wand

Xebra® is the ringmaster of this cloud carnival, conducting a symphony of efficiency and creativity. So, if you're ready to transform your HR difficulties into "whoa!" moments, board the Xebra® cloud carousel, where HR dreams take flight!

Read More...With Xebra®, you have a cash flow software that is more than just another alternative; it is the conductor of the financial orchestra. It is the best financial partner for small businesses like yours and mine, excelling at cash flow management and providin

Read More...Elevate Your Business to New Heights with Xebra

Efficiency is critical in today's fast-paced business world. Small and medium-sized businesses require a complete software solution to smoothly handle their finances, client connections, and payroll. That is where Xebra® excels as the ideal ERP (Enterprise

Read More...Struggling with invoices? Meet Xebra, your financial GPS

Say goodbye to the burden of invoice administration and hello to the efficiency and convenience of Xebra®. It's your dependable companion in the world of invoices and payments, allowing you to concentrate on building your business while keeping your money

Read More...Elevate Employee Celebrations with Xebra®

Tired of juggling employee milestones and data? Xebra®'s HRMS is here to streamline the process and add a personalized touch to your celebrations.

Read More...Experience inventory genius with Xebra®

In the fast-paced world of business, where every second counts, keeping a close check on your inventory is a must. That's where your trusted financial ally, Xebra®, comes in with its exceptional automation prowess.

Read More...Experience billing excellence with Xebra®

An online billing software like Xebra® is a game changer for a wide spectrum of enterprises in today's digital world. Whether you're a startup, a small firm, or a major corporation, Xebra® can be a valuable financial resource.

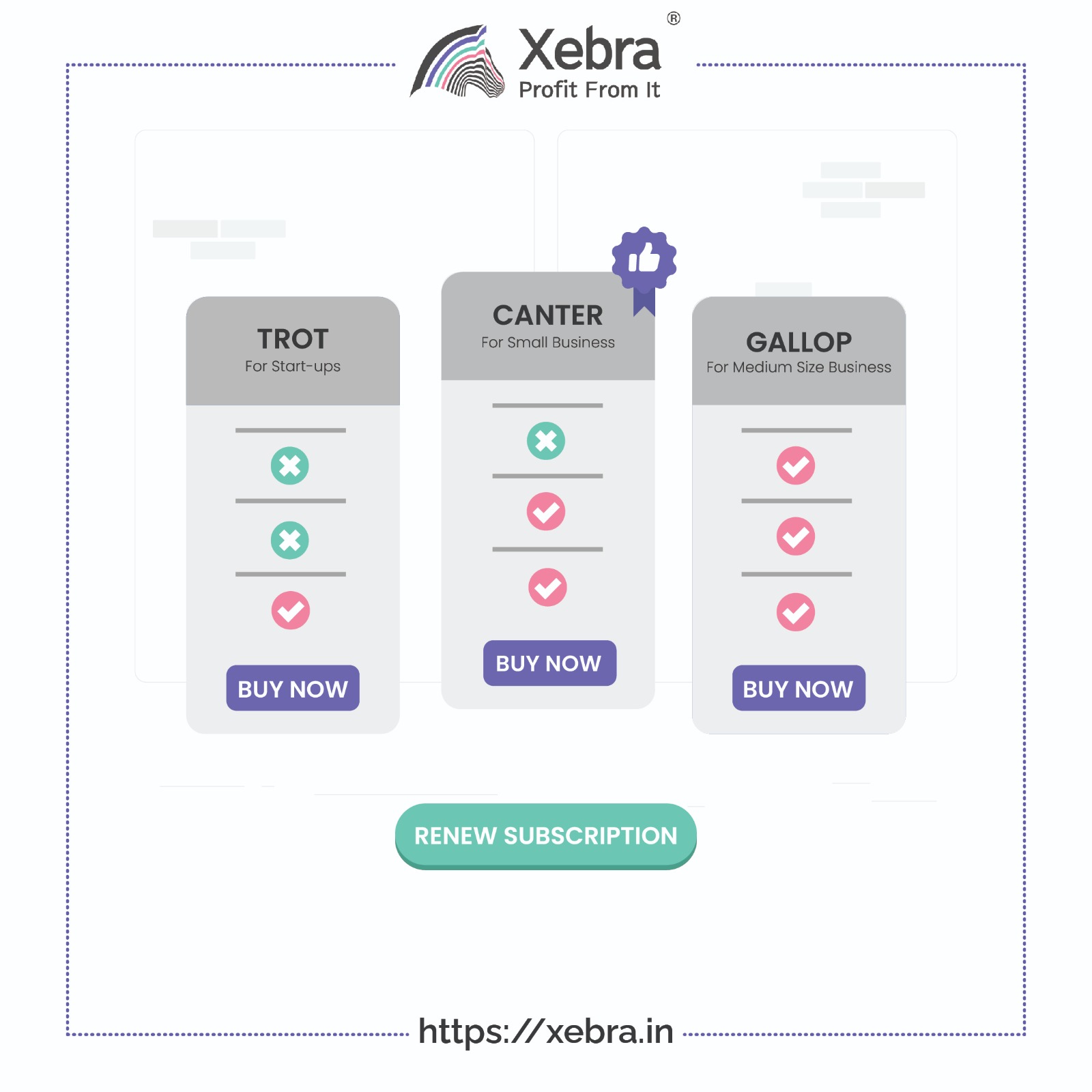

Read More...Renew your Xebra® subscription to unlock the future

Attention, Xebra® customers! We have some great news that will take your experience to new levels. It's time to renew your subscription and join us on a journey of continuous innovation.

Read More...Xebra®: Invoicing and Payments perfected

In the whirlwind of managing a small business, one thing stands as a cornerstone of success: seamless invoicing and payment handling. It's the heartbeat of your operation, ensuring a healthy financial flow.

Read More...Explore the potential of cutting-edge accounting software such as Xebra®. With its capabilities for delivering real-time insights, automated reporting, and intelligent financial solutions, Xebra® empowers you to take control of your cash flow management. I

Read More...Empower MSMEs: Xebra® HRMS - Elevate Efficiency

HRMS software is fundamentally a dynamic tool that is redefining how Micro, Small, and Medium-Sized Enterprises (MSMEs) negotiate the challenging landscape of human resource management. Imagine it as the conductor of a symphony, bringing together multiple

Read More...Effortlessly Convert Leads with Xebra® Lead Master

Are you fed up with juggling leads from several platforms and failing to convert them into paying customers? Look no further than Xebra® Lead Master, the best option for easy lead conversion that may turbocharge your company's growth.

Read More...Mastering the art of positive cash flow: Strategies for sustainable business success

When a company's cash inflows surpass its cash outflows, it has positive cash flow, indicating a good financial status. It is critical because it enables firms to immediately cover expenses, invest in growth initiatives, deal with unanticipated obstacles,

Read More...Xebra® Company Profile: Unlock your business potential today

With its user-friendly design and inventive solutions, Xebra® provides all of this and more. Put an end to manual calculations, complicated spreadsheets, and misplaced paperwork. Discover the power of Xebra® and realise your organization's full potential.

Read More...Unleash Success with the Right ERP Solution

Finding the best ERP software for your small business can be a difficult undertaking. With so many options on the market, it's critical to sort through the intricacies and choose the solution that best meets your needs.

Read More...Procure with Xebra®: Effortless purchase orders for vendors

In today's fast-paced business world, efficient purchase order management is a key factor in maintaining productivity and financial control. With Xebra®’s comprehensive purchase order capabilities, you can supercharge your procurement process and propel yo

Read More...Simplify Payments, Automated Invoices Made Easy

Payment and invoicing management is one area that can have a big impact on these elements. Manual processes can be time-consuming, error-prone, and stifle your company's growth. However, with the introduction of automated billing solutions, these difficult

Read More...Record debit notes without much hassle

Are you tired of the hassle that comes with recording debit notes? We feel you, and we've got just the thing to make your life easier. Introducing the amazing 'Debit Note' feature of Xebra®!

Read More...Xebra® ERP: Simplify Payroll, Maximize Efficiency

ERP provides a centralised system for handling employee remuneration, tax deductions, benefits administration, and compliance with labour rules and regulations when it comes to payroll management.

Read More...Recording a credit note is the simplest task of your day!

Xebra® provides a facility of client portal where they can view and download all credit notes created in their name. Auto-updating of your accounting reports in real-time Keep track of ref invoice no. with each credit note. Use filters to track your credi

Read More...Effortlessly track and manage asset sales and receipts

Effective asset management is critical for keeping a competitive edge in today's dynamic corporate climate. That's where Xebra® comes in, with a full range of features designed to expedite asset sales and optimise financial operations.

Read More...Online GST accounting software: streamlined accounting, tax compliance, efficient record-keeping

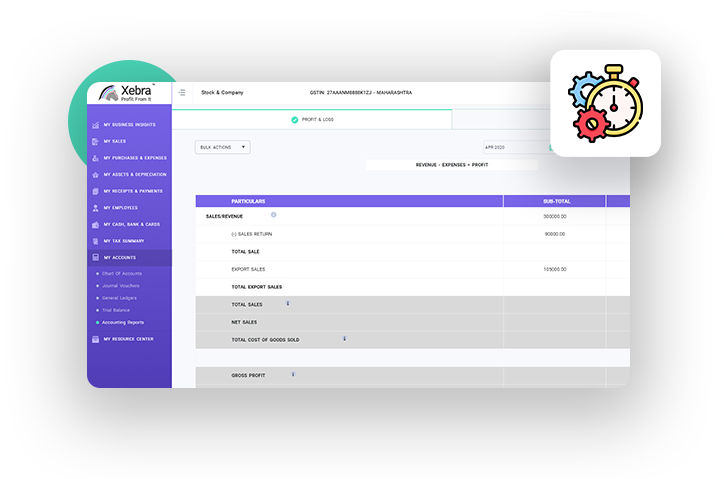

Xebra, in my opinion, is the 'go-to' accounting software in India right now. It is India's first Social MSME Business Suite, combining Business Insights, Invoicing, Expense, Purchase, Inventory, Asset, Payroll, HRMS, Bank, Tax, and Accounting modules into

Read More...Add asset & supplier entries in asset master with ease

In today's fast-paced business environment, efficient asset management is crucial for staying ahead of the competition. That's where Xebra® comes in, offering a game-changing solution that revolutionizes the way businesses handle their assets.

Read More...Unlock your business's financial potential with Xebra®- Empower and Grow

Xebra® is a game-changing business-finance application that offers a comprehensive set of features to handle expense management, and invoicing, and provide accurate balance sheets. You can quickly track purchases and expenses with Xebra®, as well as gener

Read More...CRM Implementation Excellence: Empowering Business Success

Let's look at the significant difficulties and effective solutions to them. Implementing a Customer Relationship Management (CRM) system can transform customer connections and drive firm growth. However, complications frequently develop during implementati

Read More...Streamline your journal voucher entry process with Xebra®

Maintaining appropriate financial control as a business owner or accountant is critical to the success of your company. This is where Xebra® comes into play. Our accounting software streamlines the journal voucher entry process, allowing you to easily keep

Read More...Empower your business with a complete software suite - streamline, succeed, excel

The time saved by employing a company software suite is one of the most significant benefits. You may considerably reduce data entry time and errors by integrating all relevant functions onto a single platform. You can handle your invoicing, spending, payr

Read More...Chart of Accounts entries with Xebra®

One of the most essential elements of Xebra® is its ‘Chart of Accounts’, which aids in the organisation of financial data, making it easier to analyse and manage funds.

Read More...Revolutionize your MSME's success: Unlock efficiency and boost profits with Xebra® integration

Are you fed up with the time-consuming process of handling your SME's accounts and inventory? Do you wish you had more control over your operations and could eliminate errors? There is no need to look any further! Accounting and inventory management integr

Read More...Simplify your company Event planning with Xebra's user-friendly platform

Simplify your company Event planning with Xebra's user-friendly platform

Read More...Revolutionize your Company Policy management with Xebra's digital notice board

Revolutionize your Company Policy management with Xebra's digital notice board

Read More...Streamline Item management and Taxation with Xebra

Manage your items and taxes with ease using Xebra!

Read More...With Xebra you can record and track your stock items in real- time!

It provides you sharper visibility on the stock levels to prevent loss of future sales.

Read More...Save time with Xebra’s unique vendor master module

Vendor Master simplifies your documentation and communication processes entirely.

Read More...Xebra’s unique client master module automates your documentation & communication processes entirely

Xebra’s unique client master module automates your documentation & communication processes entirely

Read More...Get employees to access Xebra to upload their investment details along with supporting documents

Centralised upload and retrieval of investment details across locations and across years

Read More...Say goodbye to physical storage of documents

In today’s digital world keeping your company documents organized is considered quite a big chore. Because these are critical papers for your business, you must guarantee that they are properly maintained, organised, and kept safe.

Read More...Track your assets between cities and employees at a glance with Xebra

It helps you to: 1. Ensure timely renewal of assets by setting alerts for a warranty expiration date and assign individual AMC providers

Read More...It helps you with: 1. Faster integrated pay-outs

Read More...Trim wasteful expenses with Xebras comprehensive analytics of your business expenses

Xebra allows you to record expenses, payments and tax with a single click. It also helps you:

Read More...Make customised and compliant invoices in less than 60 secs using Xebra

As an entrepreneur you want your invoices to appear as professional as the product or service you provide. With Xebra you can:

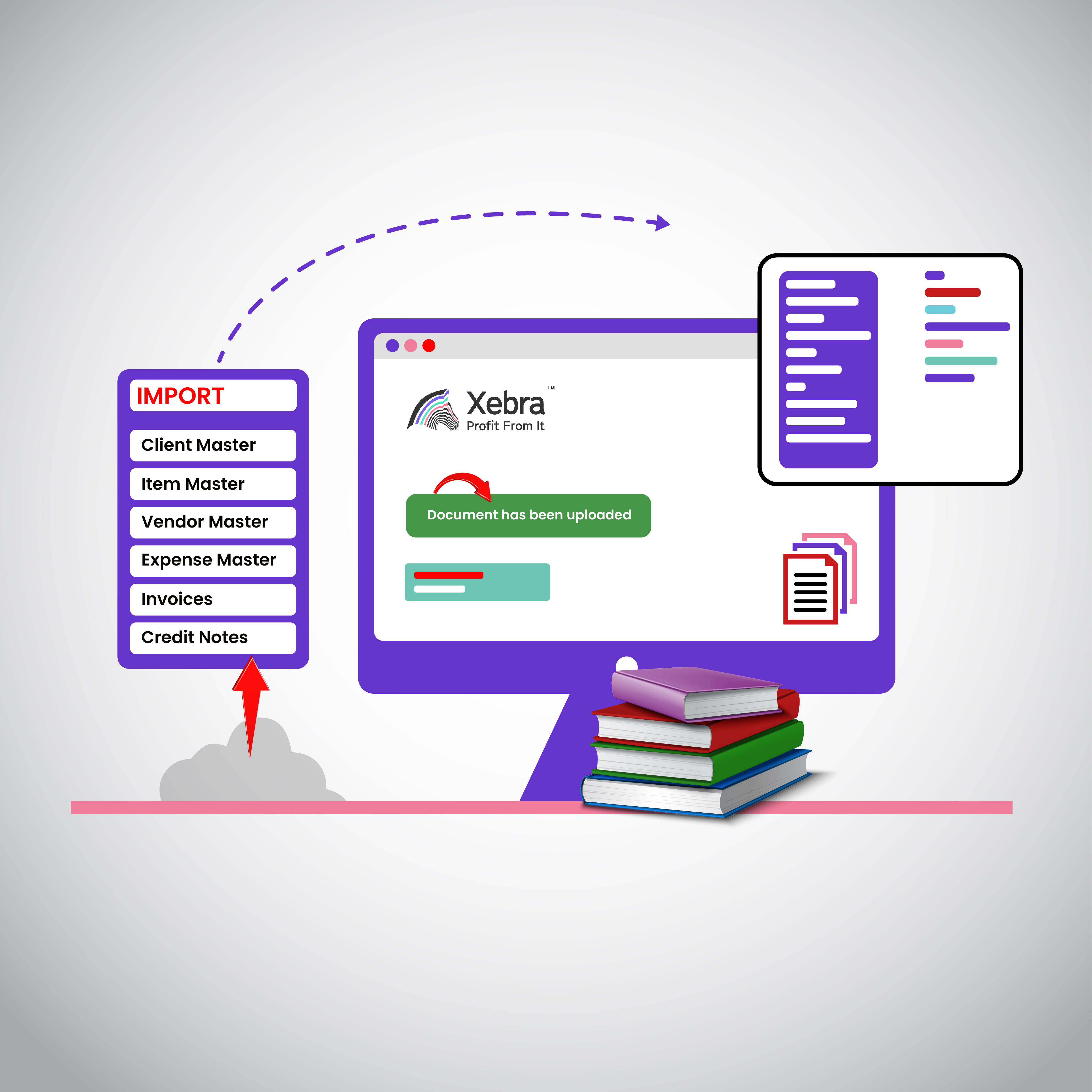

Read More...Migrate all your data from any accounting software to Xebra in three simple steps

Wondering how… 1. Go to settings and download the CSV sample file to fill in your company data

Read More...Xebra eliminates the process of physical documentation for expense vouchers entirely

Wondering how.. 1. Xebra allows customisation of expense voucher approval process for each individual company

Read More...Decode cash flow statement to boost your company’s growth

The cash flow statement is your business's third and final financial statement. It shows how money travels in and out of business, bridging the gap between the income statement and the balance sheet. A cash flow statement's fundamental structure consist

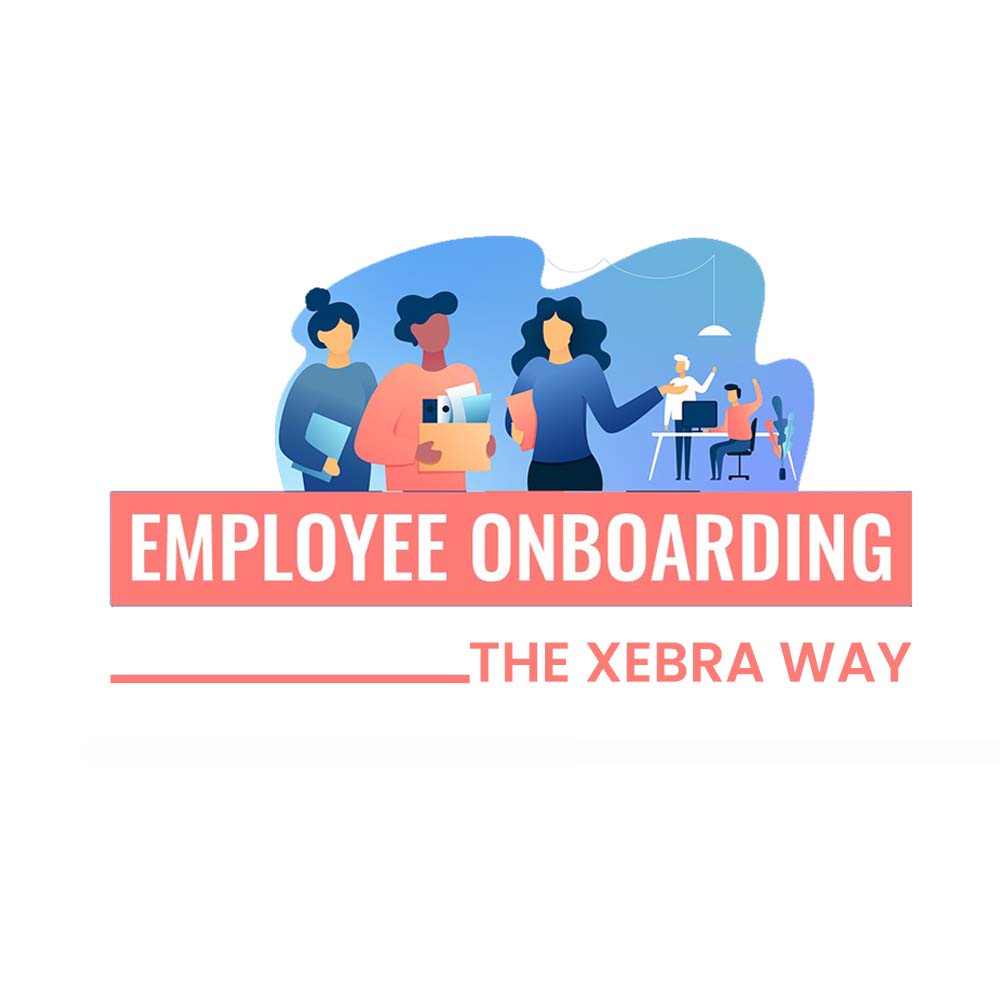

Read More...Eliminate the employee onboarding hassle with Xebra’s automation

Xebra offers centralized and automated employee onboarding as well as employee documentation storage. You can allow access to your employees where they will have access to their salary slips, appraisals, and expense vouchers.

Read More...As govt pushes for digital payments, here’s how active MSME Ministry is in transacting digitally

Credit and Finance for MSMEs: As the digital payments ecosystem continues to grow in the country with businesses and individuals adopting digital instruments such as unified payments interface (UPI)

Read More...Xebra’s Vendor Portal that streamlines payments

Xebra has provided a separate vendor portal that users can give access to their vendors. Each vendor can only see the invoices they have raised, debit notes and documents exchanged between that user.

Read More...Improve your cash flow with Xebra’s dedicated client portal

Xebra has a separate client portal that users can give out to their clients by giving them access. Each client can only see the invoices, credit notes and documents exchanged between that user.

Read More...Xebra’s smart alerts notify you when expenses can cross budgeted limit

Xebra is equipped with a smart alerts feature that helps you know if your business is growing as planned or carry out a course correction well in time.

Read More...Xebra helps you track your revenue targets that you have set client-wise or product/service wise!

Xebra is equipped with a smart alerts feature that helps you know if your business is growing as planned or carry out a course correction well in time.

Read More...Xebra is thrilled to be selected in NASSCOM 10,000 Start-ups program

We are delighted to be selected as part of the NASSCOM 10,000 Start-ups program. The NASSCOM Start-up Hub is a central community to engage with mentors, enterprises, investors, and fellow entrepreneurs.

Read More...Eliminate the hassle of manually creating monthly recurring invoices forever!

Xebra is equipped to provide you with seamless automation when it comes to carrying out your monthly recurring business-related tasks, eg. Invoicing.

Read More...Disburse monthly asset purchase payments in less than a minute!

Xebra now has a newly integrated ICICI bank that will allow you to pay your vendor for any asset purchased. The best part is you can do that within Xebra with a single click

Read More...How did digital communication change post covid?

Watch out for the founder of Xebra Mr. Nimesh Shah, enlighten us about how drastically digital communications have changed in 2020, and the different ways adopted by brands to sustain during the global pandemic.

Read More...Watch how pandemic has changed communication strategy for MSME companies

Our founder Mr. Nimesh Shah, talks about how the major shift into digital ads and targeted communities is crucial in the advertising sector due to the current pandemic.

Read More...The Evolving Landscape of Security and Privacy in FinTech

Join Women in FinTech and Women in Security and Privacy (WISP) in a collaboration panel on the future of security and privacy in the FinTech industry.

Read More...Ecommerce Agency Owner Roundtable (Virtual Event)

Sponsored by Gorgias, the no. 1 rated helpdesk for Shopify that has already assisted 5900+ businesses, this roundtable is for ecommerce agencies who want to learn from industry peers to fast track their growth

Read More...Disburse monthly company purchases in less than a minute!

Xebra now has a newly added feature of ICICI bank Integration that allows you to disburse all your monthly company purchases with a simple click! The best part? It is directly linked to your ICICI bank account and you can check your bank statement on your

Read More...Increase your cash-flow and profitability with Xebra!

Do you struggle with the constant hassle of delayed payment collections and not receiving purchase orders on time? Xebra solves this problem in 3 simple steps with its special feature- Smart Document Locker!

Read More...Multiple GST no’s delayed your tax calculation and accounting entries?

Xebra absolutely eliminates the daily hassle of juggling through multiple profiles to create invoices using several GSTIN no’s! How? With the help of a simple click.

Read More...Disburse employee monthly salaries in less than a minute!

Xebra now has a newly added feature of ICICI bank Integration that allows you to disburse all your monthly salaries and pay slips with a few simple clicks!

Read More...Disburse your monthly Company Expenses in under a minute!

Xebra now has a newly added feature of ICICI bank Integration that allows you to disburse all your monthly company expenses with a simple click. The best part? It is directly linked to your ICICI bank account and you can check your bank statement on your X

Read More...Ways to Improve your cash flow and collect money faster from your clients

We have multiple features that have been designed to help MSME founders improve their cash flow. Our analytics module allows getting client-wise details and the action that can be taken to collect dues faster.

Read More...Step by step guide to kick-start your small business

Covid19 has set back a lot of small businesses since 2020, and I’m sure you decided to read this blog because you are trying to find new innovative ways to save time and money as well as grow your start-up. Almost every individual dreams about starting his

Read More...How can you maintain accounting accuracy for your small business?

It is easy to side line your accounting duties to one side while you focus on the day-to-day smooth running of your small business. Invoices are either lost or mixed up, and are haphazardly saved somewhere on your

Read More...Onboarding Simplified for MSMEs

SME processes of today are very different than those of the past, especially since the onset of covid19. As a result of the digital wave, SMEs are among the most zealous adopters of latest technologies like SaaS based cloud accounting softwares.

Read More...How & Why Saas tools can help your small business?

Software as a service (SaaS) (also known as on-demand software) is a software licensing and distribution model. A centrally hosted software is provided to customers through a licensed subscription over the Internet.

Read More...Should SMEs in India buy Saas applications and other online tools to become efficient and effective

I feel that in recent times especially after the outbreak of covid-19, every CA in this world uses software for systematic, exact and accurate accounting. Those are mainly in ERP software like Xebra, Xero, Tally, Marg, SAP etc. These applications help you

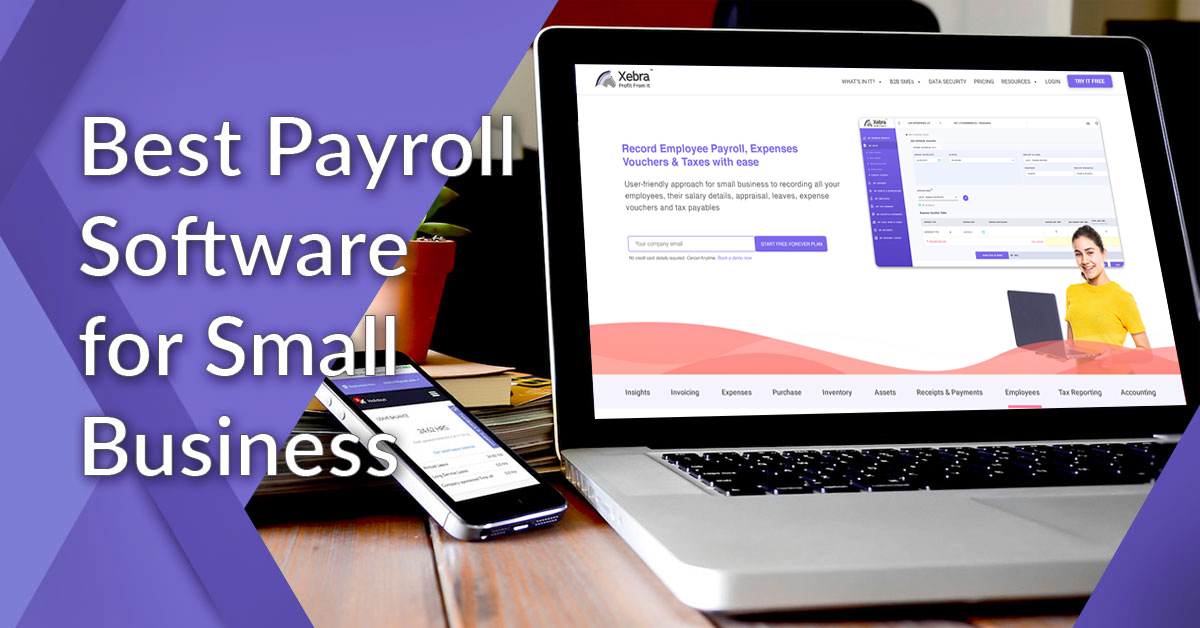

Read More...While there are many payroll services providers who are present in India today, if you google for ‘Payroll software providers in India’, it will showcase at least 5,00,000 results to browse through. So with so much information available, how does one choos

Read More...How does an invoicing software work?

Invoicing software’s are basically online software’s that are made to help businesses get paid faster and function to their uttermost efficiency. It can handle a vast database of your clients and makes your job easy through its smart work and job systems.

Read More...What are the basic accounting disciplines that small companies and start-ups should follow?

As an entrepreneur I am sure you’ve turned your great idea into a lucrative business opportunity, started making sales, and are now thinking about processes that can help take your business to the next level.

Read More...SaaS application that streamlines your accounting, invoicing, and payroll needs of your business.

In the past, accounting software was complex and cumbersome. It was generally more suitable for large enterprises than small businesses. Now, there’s a huge range of accounting software that’s been designed especially for small businesses and the self-empl

Read More...Accounting is a time-tested discipline. In this world, achieving a resilient and sustainable business model has never been more challenging. Quite a lot of experts agree that small businesses commonly fail when cash flow runs dry.

Read More...Accountant Vs. Bookkeeper- What’s the difference?

Whether you're a start-up or an established business, keeping track of your financials is essential to making informed business decisions. That's when accounting and bookkeeping services comes in.

Read More...Will accountants be replaced by computers in the coming years?

The instantaneous answer for this question would be a firm No. But, if someone would have asked you in the 1980s whether a driverless car is possible, people would have thought that you are probably crazy and talking sheer nonsense.

Read More...Is an online business and finance software the right move for your small business?

As an entrepreneur you already have a ton of responsibilities on your plate. You do not need to add any more. In fact, what if I told you that there was a way to lessen the amount of things that you need to worry about while running your business daily.

Read More...Should small business outsource their bookkeeping requirement or carry it out in-house?

Covid has majorly impacted a lot of small businesses since 2020, and I’m sure that you are reading this article because you are trying to find new innovative ways to save time and money as well as grow your small business.

Read More...What are the accounting alternatives to tally for a small business?

Are you looking for an automated solution to all your biz-finance needs? We're here to save you a lot of time! If you consider Tally, you may also want to investigate similar alternatives or competitors to find the best biz-finance software for your busine

Read More...All You Need to know about Banking Terms

The full form of RTGS is Real Time Gross Settlement, it is a money transfer process that is performed in real-time and without delays. RTGS requires Net Payment which implies that activities are carried out at an individual level without delay and not in b

Read More...Everything you wanted to know about Tax Deducted at Source TDS

What does TDS stand for? TDS stands for tax deducted at source. When is TDS to be deducted? According to the income tax act, in case of certain prescribed payments (E.g. Interest, commission, brokerage, rent, etc.), the person making the payment is requir

Read More...5 Ways Small Business Are Adopting Cloud Software

Small businesses need to find the right tools to remain competitive in the market. And with the rise of cloud technology, they can now operate more efficiently and effectively than ever.

Read More...In Conversation with Nimesh Shah Xebra Business Financial Suite

Nimesh Shah is the founder of Xebra Business Financial Suite for Marketing Communication Agencies. It integrates Business Intelligence + Invoicing + Banking + Accounting all rolled into one.

Read More...How Cloud Accounting Can Help Small Business

Whether you have one employee or 1,000 employees, whether you are a small business with few employees or a large company with hundreds of employees, it can help you manage all your accounting, financial data and even your customer’s address.

Read More...Don’t let the lockdown impact your business

There are still a series of applications that you use it carry out work while being at home, here's a list of 5 SaaS application that have a free version and can assist you across different functions of yours.

Read More...Why every founder must do business financial analysis during this lockdown

While desperate times require desperate measures, it is advisable to take stock of the situation. Simplifying business numbers is a step in that direction. In times of peace, prepare for war – this quote has been around for a while, and is very close to th

Read More...Four free business applications you can use while working from home

Few things irritate more than signing up to a SaaS product only to find that most of its features aren’t available in trial version or that it isn’t what you expected it to be. And this happening during the lockdown can be further frustrating.

Read More...The 10 features in an ideal Online Invoicing Software

Whether you’re a service provider or a product-based enterprise, today’s market is getting competitive than it was ever before. Retaining clients & growing revenue is the key to business growth.

Read More...As govt pushes for digital payments, here’s how active MSME Ministry is in transacting digitally

Credit and Finance for MSMEs: As the digital payments ecosystem continues to grow in the country with businesses and individuals adopting digital instruments such as unified payments interface (UPI)

Read More...Xebra is thrilled to be selected in NASSCOM 10,000 Start-ups program

We are delighted to be selected as part of the NASSCOM 10,000 Start-ups program. The NASSCOM Start-up Hub is a central community to engage with mentors, enterprises, investors, and fellow entrepreneurs.

Read More...The Evolving Landscape of Security and Privacy in FinTech

Join Women in FinTech and Women in Security and Privacy (WISP) in a collaboration panel on the future of security and privacy in the FinTech industry.

Read More...Ecommerce Agency Owner Roundtable (Virtual Event)

Sponsored by Gorgias, the no. 1 rated helpdesk for Shopify that has already assisted 5900+ businesses, this roundtable is for ecommerce agencies who want to learn from industry peers to fast track their growth

Read More...How did digital communication change post covid?

Watch out for the founder of Xebra Mr. Nimesh Shah, enlighten us about how drastically digital communications have changed in 2020, and the different ways adopted by brands to sustain during the global pandemic.

Read More...Watch how pandemic has changed communication strategy for MSME companies

Our founder Mr. Nimesh Shah, talks about how the major shift into digital ads and targeted communities is crucial in the advertising sector due to the current pandemic.

Read More...In Conversation with Nimesh Shah Xebra Business Financial Suite

Nimesh Shah is the founder of Xebra Business Financial Suite for Marketing Communication Agencies. It integrates Business Intelligence + Invoicing + Banking + Accounting all rolled into one.

Read More...Why every founder must do business financial analysis during this lockdown

While desperate times require desperate measures, it is advisable to take stock of the situation. Simplifying business numbers is a step in that direction. In times of peace, prepare for war – this quote has been around for a while, and is very close to th

Read More...Four free business applications you can use while working from home

Few things irritate more than signing up to a SaaS product only to find that most of its features aren’t available in trial version or that it isn’t what you expected it to be. And this happening during the lockdown can be further frustrating.

Read More...Charting the course for future enterprise software adoption

Navigating the successful adoption of new enterprise software is akin to orchestrating a transformation rather than just implementing a tool. Picture it as a journey, where a tailored strategy becomes your map for seamless navigation.

Read More...Less juggle, more success: Your business wingman at play

Xebra® is one such software that excels at giving you the advantages of managing your accounting, bookkeeping, payroll, and customer connections. With its user-friendly design and comprehensive capabilities, Xebra® enables MSMEs to efficiently manage thei

Read More...6 Invoicing secrets you wish you knew

Xebra®, on the other hand, is the cream of the crop when it comes to invoicing software. It's like that dependable, experienced first mate you can always rely on. It's designed for small businesses like yours, with a user-friendly interface, mobility choic

Read More...Excel in payments, bookkeeping, and invoicing mastery

Allow us to reveal the ultimate game changer for your business: selecting the right online payment solution, handling bookkeeping like a pro, and slipping those invoices to your clients in style.

Read More...Your business's Sherlock Holmes: Unraveling the mystery of All-in-One solutions!

We're embarking on an exhilarating journey into the realm of ERP brilliance, guided by the wit, humour, and enchanting magic of Xebra®.

Read More...Where billing glam meets a party vibe

Efficiency, customization that turns heads, and an invoice dance party await. Say hello to Xebra® magic, where your billing journey transforms into a legendary adventure!

Read More...Ditch the numbers crunch, dance with Xebra®

Say goodbye to billing headaches and hello to the sweet melody of automation, courtesy of Xebra®'s scalable, user-friendly, and cost-effective features. Imagine a future where saving money is as simple as a tap on your tablet, and your financial path becom

Read More...Navigating HR waters? Xebra's got the magic wand

Xebra® is the ringmaster of this cloud carnival, conducting a symphony of efficiency and creativity. So, if you're ready to transform your HR difficulties into "whoa!" moments, board the Xebra® cloud carousel, where HR dreams take flight!

Read More...With Xebra®, you have a cash flow software that is more than just another alternative; it is the conductor of the financial orchestra. It is the best financial partner for small businesses like yours and mine, excelling at cash flow management and providin

Read More...Elevate Your Business to New Heights with Xebra

Efficiency is critical in today's fast-paced business world. Small and medium-sized businesses require a complete software solution to smoothly handle their finances, client connections, and payroll. That is where Xebra® excels as the ideal ERP (Enterprise

Read More...Struggling with invoices? Meet Xebra, your financial GPS

Say goodbye to the burden of invoice administration and hello to the efficiency and convenience of Xebra®. It's your dependable companion in the world of invoices and payments, allowing you to concentrate on building your business while keeping your money

Read More...Experience billing excellence with Xebra®

An online billing software like Xebra® is a game changer for a wide spectrum of enterprises in today's digital world. Whether you're a startup, a small firm, or a major corporation, Xebra® can be a valuable financial resource.

Read More...Xebra®: Invoicing and Payments perfected

In the whirlwind of managing a small business, one thing stands as a cornerstone of success: seamless invoicing and payment handling. It's the heartbeat of your operation, ensuring a healthy financial flow.

Read More...Explore the potential of cutting-edge accounting software such as Xebra®. With its capabilities for delivering real-time insights, automated reporting, and intelligent financial solutions, Xebra® empowers you to take control of your cash flow management. I

Read More...Empower MSMEs: Xebra® HRMS - Elevate Efficiency

HRMS software is fundamentally a dynamic tool that is redefining how Micro, Small, and Medium-Sized Enterprises (MSMEs) negotiate the challenging landscape of human resource management. Imagine it as the conductor of a symphony, bringing together multiple

Read More...Mastering the art of positive cash flow: Strategies for sustainable business success

When a company's cash inflows surpass its cash outflows, it has positive cash flow, indicating a good financial status. It is critical because it enables firms to immediately cover expenses, invest in growth initiatives, deal with unanticipated obstacles,

Read More...Unleash Success with the Right ERP Solution

Finding the best ERP software for your small business can be a difficult undertaking. With so many options on the market, it's critical to sort through the intricacies and choose the solution that best meets your needs.

Read More...Simplify Payments, Automated Invoices Made Easy

Payment and invoicing management is one area that can have a big impact on these elements. Manual processes can be time-consuming, error-prone, and stifle your company's growth. However, with the introduction of automated billing solutions, these difficult

Read More...Xebra® ERP: Simplify Payroll, Maximize Efficiency

ERP provides a centralised system for handling employee remuneration, tax deductions, benefits administration, and compliance with labour rules and regulations when it comes to payroll management.

Read More...Online GST accounting software: streamlined accounting, tax compliance, efficient record-keeping

Xebra, in my opinion, is the 'go-to' accounting software in India right now. It is India's first Social MSME Business Suite, combining Business Insights, Invoicing, Expense, Purchase, Inventory, Asset, Payroll, HRMS, Bank, Tax, and Accounting modules into

Read More...Unlock your business's financial potential with Xebra®- Empower and Grow

Xebra® is a game-changing business-finance application that offers a comprehensive set of features to handle expense management, and invoicing, and provide accurate balance sheets. You can quickly track purchases and expenses with Xebra®, as well as gener

Read More...CRM Implementation Excellence: Empowering Business Success

Let's look at the significant difficulties and effective solutions to them. Implementing a Customer Relationship Management (CRM) system can transform customer connections and drive firm growth. However, complications frequently develop during implementati

Read More...Empower your business with a complete software suite - streamline, succeed, excel

The time saved by employing a company software suite is one of the most significant benefits. You may considerably reduce data entry time and errors by integrating all relevant functions onto a single platform. You can handle your invoicing, spending, payr

Read More...Revolutionize your MSME's success: Unlock efficiency and boost profits with Xebra® integration

Are you fed up with the time-consuming process of handling your SME's accounts and inventory? Do you wish you had more control over your operations and could eliminate errors? There is no need to look any further! Accounting and inventory management integr

Read More...Say goodbye to physical storage of documents

In today’s digital world keeping your company documents organized is considered quite a big chore. Because these are critical papers for your business, you must guarantee that they are properly maintained, organised, and kept safe.

Read More...Make customised and compliant invoices in less than 60 secs using Xebra

As an entrepreneur you want your invoices to appear as professional as the product or service you provide. With Xebra you can:

Read More...Decode cash flow statement to boost your company’s growth

The cash flow statement is your business's third and final financial statement. It shows how money travels in and out of business, bridging the gap between the income statement and the balance sheet. A cash flow statement's fundamental structure consist

Read More...Step by step guide to kick-start your small business

Covid19 has set back a lot of small businesses since 2020, and I’m sure you decided to read this blog because you are trying to find new innovative ways to save time and money as well as grow your start-up. Almost every individual dreams about starting his

Read More...How can you maintain accounting accuracy for your small business?

It is easy to side line your accounting duties to one side while you focus on the day-to-day smooth running of your small business. Invoices are either lost or mixed up, and are haphazardly saved somewhere on your

Read More...Onboarding Simplified for MSMEs

SME processes of today are very different than those of the past, especially since the onset of covid19. As a result of the digital wave, SMEs are among the most zealous adopters of latest technologies like SaaS based cloud accounting softwares.

Read More...How & Why Saas tools can help your small business?

Software as a service (SaaS) (also known as on-demand software) is a software licensing and distribution model. A centrally hosted software is provided to customers through a licensed subscription over the Internet.

Read More...Should SMEs in India buy Saas applications and other online tools to become efficient and effective

I feel that in recent times especially after the outbreak of covid-19, every CA in this world uses software for systematic, exact and accurate accounting. Those are mainly in ERP software like Xebra, Xero, Tally, Marg, SAP etc. These applications help you

Read More...While there are many payroll services providers who are present in India today, if you google for ‘Payroll software providers in India’, it will showcase at least 5,00,000 results to browse through. So with so much information available, how does one choos

Read More...How does an invoicing software work?

Invoicing software’s are basically online software’s that are made to help businesses get paid faster and function to their uttermost efficiency. It can handle a vast database of your clients and makes your job easy through its smart work and job systems.

Read More...What are the basic accounting disciplines that small companies and start-ups should follow?

As an entrepreneur I am sure you’ve turned your great idea into a lucrative business opportunity, started making sales, and are now thinking about processes that can help take your business to the next level.

Read More...SaaS application that streamlines your accounting, invoicing, and payroll needs of your business.

In the past, accounting software was complex and cumbersome. It was generally more suitable for large enterprises than small businesses. Now, there’s a huge range of accounting software that’s been designed especially for small businesses and the self-empl

Read More...Accounting is a time-tested discipline. In this world, achieving a resilient and sustainable business model has never been more challenging. Quite a lot of experts agree that small businesses commonly fail when cash flow runs dry.

Read More...Accountant Vs. Bookkeeper- What’s the difference?

Whether you're a start-up or an established business, keeping track of your financials is essential to making informed business decisions. That's when accounting and bookkeeping services comes in.

Read More...Will accountants be replaced by computers in the coming years?

The instantaneous answer for this question would be a firm No. But, if someone would have asked you in the 1980s whether a driverless car is possible, people would have thought that you are probably crazy and talking sheer nonsense.

Read More...Is an online business and finance software the right move for your small business?

As an entrepreneur you already have a ton of responsibilities on your plate. You do not need to add any more. In fact, what if I told you that there was a way to lessen the amount of things that you need to worry about while running your business daily.

Read More...Should small business outsource their bookkeeping requirement or carry it out in-house?

Covid has majorly impacted a lot of small businesses since 2020, and I’m sure that you are reading this article because you are trying to find new innovative ways to save time and money as well as grow your small business.

Read More...What are the accounting alternatives to tally for a small business?

Are you looking for an automated solution to all your biz-finance needs? We're here to save you a lot of time! If you consider Tally, you may also want to investigate similar alternatives or competitors to find the best biz-finance software for your busine

Read More...All You Need to know about Banking Terms

The full form of RTGS is Real Time Gross Settlement, it is a money transfer process that is performed in real-time and without delays. RTGS requires Net Payment which implies that activities are carried out at an individual level without delay and not in b

Read More...Everything you wanted to know about Tax Deducted at Source TDS

What does TDS stand for? TDS stands for tax deducted at source. When is TDS to be deducted? According to the income tax act, in case of certain prescribed payments (E.g. Interest, commission, brokerage, rent, etc.), the person making the payment is requir

Read More...5 Ways Small Business Are Adopting Cloud Software

Small businesses need to find the right tools to remain competitive in the market. And with the rise of cloud technology, they can now operate more efficiently and effectively than ever.

Read More...How Cloud Accounting Can Help Small Business

Whether you have one employee or 1,000 employees, whether you are a small business with few employees or a large company with hundreds of employees, it can help you manage all your accounting, financial data and even your customer’s address.

Read More...Don’t let the lockdown impact your business

There are still a series of applications that you use it carry out work while being at home, here's a list of 5 SaaS application that have a free version and can assist you across different functions of yours.

Read More...The 10 features in an ideal Online Invoicing Software

Whether you’re a service provider or a product-based enterprise, today’s market is getting competitive than it was ever before. Retaining clients & growing revenue is the key to business growth.

Read More...Turn the Petty Cash chaos around.

Ever found yourself wrestling with the complexities of petty cash management? Fear not, for our ERP system, Xebra®, is here to transform your financial struggles into victories! You know that feeling when petty cash becomes a puzzle, and you're left wonde

Read More...TDS asset mastery: Click, Win, Pay

Xebra® stands out as your go-to buddy for stress-free TDS management in a world where simplicity is a rare diamond. Say goodbye to tax-related difficulties and hello to a more efficient, simpler manner of managing your finances. Managing TDS has never been

Read More...Elevate Employee Celebrations with Xebra®

Tired of juggling employee milestones and data? Xebra®'s HRMS is here to streamline the process and add a personalized touch to your celebrations.

Read More...Experience inventory genius with Xebra®

In the fast-paced world of business, where every second counts, keeping a close check on your inventory is a must. That's where your trusted financial ally, Xebra®, comes in with its exceptional automation prowess.

Read More...Renew your Xebra® subscription to unlock the future

Attention, Xebra® customers! We have some great news that will take your experience to new levels. It's time to renew your subscription and join us on a journey of continuous innovation.

Read More...Effortlessly Convert Leads with Xebra® Lead Master

Are you fed up with juggling leads from several platforms and failing to convert them into paying customers? Look no further than Xebra® Lead Master, the best option for easy lead conversion that may turbocharge your company's growth.

Read More...Xebra® Company Profile: Unlock your business potential today

With its user-friendly design and inventive solutions, Xebra® provides all of this and more. Put an end to manual calculations, complicated spreadsheets, and misplaced paperwork. Discover the power of Xebra® and realise your organization's full potential.

Read More...Procure with Xebra®: Effortless purchase orders for vendors

In today's fast-paced business world, efficient purchase order management is a key factor in maintaining productivity and financial control. With Xebra®’s comprehensive purchase order capabilities, you can supercharge your procurement process and propel yo

Read More...Record debit notes without much hassle

Are you tired of the hassle that comes with recording debit notes? We feel you, and we've got just the thing to make your life easier. Introducing the amazing 'Debit Note' feature of Xebra®!

Read More...Recording a credit note is the simplest task of your day!

Xebra® provides a facility of client portal where they can view and download all credit notes created in their name. Auto-updating of your accounting reports in real-time Keep track of ref invoice no. with each credit note. Use filters to track your credi

Read More...Effortlessly track and manage asset sales and receipts

Effective asset management is critical for keeping a competitive edge in today's dynamic corporate climate. That's where Xebra® comes in, with a full range of features designed to expedite asset sales and optimise financial operations.

Read More...Add asset & supplier entries in asset master with ease

In today's fast-paced business environment, efficient asset management is crucial for staying ahead of the competition. That's where Xebra® comes in, offering a game-changing solution that revolutionizes the way businesses handle their assets.

Read More...Streamline your journal voucher entry process with Xebra®

Maintaining appropriate financial control as a business owner or accountant is critical to the success of your company. This is where Xebra® comes into play. Our accounting software streamlines the journal voucher entry process, allowing you to easily keep

Read More...Chart of Accounts entries with Xebra®

One of the most essential elements of Xebra® is its ‘Chart of Accounts’, which aids in the organisation of financial data, making it easier to analyse and manage funds.

Read More...Simplify your company Event planning with Xebra's user-friendly platform

Simplify your company Event planning with Xebra's user-friendly platform

Read More...Revolutionize your Company Policy management with Xebra's digital notice board

Revolutionize your Company Policy management with Xebra's digital notice board

Read More...Streamline Item management and Taxation with Xebra

Manage your items and taxes with ease using Xebra!

Read More...With Xebra you can record and track your stock items in real- time!

It provides you sharper visibility on the stock levels to prevent loss of future sales.

Read More...Save time with Xebra’s unique vendor master module

Vendor Master simplifies your documentation and communication processes entirely.

Read More...Xebra’s unique client master module automates your documentation & communication processes entirely

Xebra’s unique client master module automates your documentation & communication processes entirely

Read More...Get employees to access Xebra to upload their investment details along with supporting documents

Centralised upload and retrieval of investment details across locations and across years

Read More...Track your assets between cities and employees at a glance with Xebra

It helps you to: 1. Ensure timely renewal of assets by setting alerts for a warranty expiration date and assign individual AMC providers

Read More...It helps you with: 1. Faster integrated pay-outs

Read More...Trim wasteful expenses with Xebras comprehensive analytics of your business expenses

Xebra allows you to record expenses, payments and tax with a single click. It also helps you:

Read More...Migrate all your data from any accounting software to Xebra in three simple steps

Wondering how… 1. Go to settings and download the CSV sample file to fill in your company data

Read More...Xebra eliminates the process of physical documentation for expense vouchers entirely

Wondering how.. 1. Xebra allows customisation of expense voucher approval process for each individual company

Read More...Eliminate the employee onboarding hassle with Xebra’s automation

Xebra offers centralized and automated employee onboarding as well as employee documentation storage. You can allow access to your employees where they will have access to their salary slips, appraisals, and expense vouchers.

Read More...Xebra’s Vendor Portal that streamlines payments

Xebra has provided a separate vendor portal that users can give access to their vendors. Each vendor can only see the invoices they have raised, debit notes and documents exchanged between that user.

Read More...Improve your cash flow with Xebra’s dedicated client portal

Xebra has a separate client portal that users can give out to their clients by giving them access. Each client can only see the invoices, credit notes and documents exchanged between that user.

Read More...Xebra’s smart alerts notify you when expenses can cross budgeted limit

Xebra is equipped with a smart alerts feature that helps you know if your business is growing as planned or carry out a course correction well in time.

Read More...Xebra helps you track your revenue targets that you have set client-wise or product/service wise!

Xebra is equipped with a smart alerts feature that helps you know if your business is growing as planned or carry out a course correction well in time.

Read More...Eliminate the hassle of manually creating monthly recurring invoices forever!

Xebra is equipped to provide you with seamless automation when it comes to carrying out your monthly recurring business-related tasks, eg. Invoicing.

Read More...Disburse monthly asset purchase payments in less than a minute!

Xebra now has a newly integrated ICICI bank that will allow you to pay your vendor for any asset purchased. The best part is you can do that within Xebra with a single click

Read More...Disburse monthly company purchases in less than a minute!

Xebra now has a newly added feature of ICICI bank Integration that allows you to disburse all your monthly company purchases with a simple click! The best part? It is directly linked to your ICICI bank account and you can check your bank statement on your

Read More...Increase your cash-flow and profitability with Xebra!

Do you struggle with the constant hassle of delayed payment collections and not receiving purchase orders on time? Xebra solves this problem in 3 simple steps with its special feature- Smart Document Locker!

Read More...Multiple GST no’s delayed your tax calculation and accounting entries?

Xebra absolutely eliminates the daily hassle of juggling through multiple profiles to create invoices using several GSTIN no’s! How? With the help of a simple click.

Read More...Disburse employee monthly salaries in less than a minute!

Xebra now has a newly added feature of ICICI bank Integration that allows you to disburse all your monthly salaries and pay slips with a few simple clicks!

Read More...Disburse your monthly Company Expenses in under a minute!

Xebra now has a newly added feature of ICICI bank Integration that allows you to disburse all your monthly company expenses with a simple click. The best part? It is directly linked to your ICICI bank account and you can check your bank statement on your X

Read More...Ways to Improve your cash flow and collect money faster from your clients

We have multiple features that have been designed to help MSME founders improve their cash flow. Our analytics module allows getting client-wise details and the action that can be taken to collect dues faster.

Read More...I- Insights

All You Need to know about Banking Terms

By Ava Daruwalla | August 07, 2021

What is the Full form of RTGS?

The full form of RTGS is Real Time Gross Settlement, it is a money transfer process that is performed in real-time and without delays. RTGS requires Net Payment which implies that activities are carried out at an individual level without delay and not in batch-wise process. RTGS is one of the fastest methods of transferring Interbank funds via online banking in India. Transfer of the funds takes place between the two accounts in 30 minutes. While transferring money using RTGS method the following information is required

- The amount of money which is to be transferred

- Name of recipient and payee

- Name of payee and recipient bank

- Payee/beneficiary bank IFSC code

- Payee/beneficiary bank account number

The RTGS money transfer method is operated by the Indian Reserve Bank and thus it is one of the famous and safe methods of transfer of funds.

Advantages of RTGS

RTGS is a common approach of transfer of funds in India, with a variety of features. The advantages of using RTGS as the procedure for money transfers are:

- Reserve Bank of India maintains the RTGS system, which is a secure and safe method of funding.

- There is no room for lag since activities are carried out on a real-time basis.

- The use of RTGS in India is without geographical boundaries.

- Fund transfer is very convenient and can be done from the office or home.

Difference Between RTGS and NEFT

RTGS refers to Real-Time Gross Settlement. Under this scheme, the beneficiary bank provides direct instructions for the transfer. The payment is gross, so each transaction is performed individually. These payments are final, and cannot be withdrawn.

The main difference between NEFT and RTGS is that, unlike RTGS, the movement of funds occurs in batches. Hourly intervals are fixed for this reason, and the settlement is assigned to one such time slot.

What is the full form of NEFT?

The full form of NEFT is the National Electronic Fund Transfer. Banking has become an important part of our daily lives. Since the time it became online, a number of our activities have been easy to manage. You don’t have to go to the bank and wait in long lines for money transfer like before. You no longer have to fill up cheques, withdrawal forms, and chaplains. NEFT is one of the online money transfer methods which are currently in use.

NEFT is a centralized nationwide payment method owned and controlled by the Reserve Bank of India (RBI). It easily transfers money between banks across India. A bank branch should be NEFT enabled to permit a customer to transfer the funds to another party.

Some of the points to be considered while transferring money through NEFT.

- NEFT transaction timing on weekdays from 9.00 am to 7.00 pm and Saturday 9.00 am to 1.00 pm.

- There is no transaction limit, but Rs. 50,000 is per transaction limit.

National Electronic Fund Transfer Process

When individual wishes to transfer an amount of money from his bank account to another person’s bank account, he may do so through the NEFT process rather than withdrawing the money and then paying it in cash or by issuing a cheque. NEFT has the primary benefit that it can transfer funds from any branch account to any other bank account at any given venue. The only condition is that both the sender and the recipient branches are NEFT-enabled. On the RBI website, you can check the list of NEFT-enabled bank branches, or call your bank’s customer service to confirm the same. The NEFT process also allows for cross-border, one-way movement of funds from India to Nepal under the Indo-Nepal Remittance Facility Scheme.

Steps to Follow To Transfer Money Through NEFT

The Bank IFSC Code, along with other information such as account holder name, bank account number, bank branch and additional information, is a must for authorizing an NEFT transfer.

- Step 1-Use your user ID and password to sign in to your online banking account.

- Step 2-Go to NEFT Fund Transfer page.

- Step 3- Enter recipient name, bank account number and IFSC code.

- Step 4-You should initiate an NEFT transfer once the beneficiary is successfully connected. Enter the amount to be transferred and click the send button.

Advantages of NEFT System

- There is no need for the physical presence of any party to perform a transaction.

- No bank visit is required, as long as an individual is keeping a valid bank account.

- NEFT is efficient and straightforward. It can be done in less than a minute, and hardly involves any significant formality.

- Confirmation of a successful transaction can be viewed easily via email notifications and text messages.

Definition of NEFT

National Electronic Fund Transfer or NEFT is defined as a countrywide fund transfer mechanism through which an individual or a company can easily transfer money from one account/bank/branch to another. The system is based on the Deferred Net Settlement, where the transactions are processed in hourly batches. In this system, the transactions are held up for a specific time.

The system was first introduced in the year Nov 2005 to replace Special Electronic Fund Transfer (SEFT). As per Reserve Bank of India (RBI) diktat, it was mandatory for all banks to switch to the NEFT system from SEFT system. Since then, the SEFT system is not in vogue.

Only the NEFT-enabled bank branches are authorized to proceed the NEFT transactions. All the persons who are having a bank account with an NEFT-enabled bank branch are eligible to transfer money with the help of this system. However, having a bank account is not necessary, an individual/company can also deposit cash with the bank instructing the transfer of funds through NEFT. Such customers are known as Walk in customers.

The bank charges a nominal amount for providing such facility known as processing or service charges.

Definition of RTGS

The electronic system in which the transfer of funds is made on the online real-time basis is known as RTGS or Real Time Gross Settlement. Real time refers to the processing of transactions that is made at the same time when the order is received. In this way, there is no further delay in settling transactions. Gross means every single transaction is settled individually or one to one basis.

RTGS system is maintained by the Central Bank of India, and hence the transactions appear in the books of RBI. It applies to amounts equal to or higher than Rs. 2,00,000. Only the RTGS-enabled branches are allowed to take part in the RTGS transaction. There are more than 1,00,000 branches all over the country which are a part of this scheme.

These transactions are processed continuously during the business hours. The bank charges a nominal amount for providing such facility, but it is levied only to the outward transaction and not to inward transaction.

NEFT:

- NEFT stands for National Electronic Fund Transfer.

- It is used to transfer funds from one bank to another across the country.

- NEFT is a service by RBI.

- There will be time limits for NEFT. The transfer will effect within the same day if it is within the limit. Else it will take one more working day.

- Minimum amount – Rs. 1.

- Maximum amount – No upper limit, but normally RTGS is used to transfer Rs. 2,00,000 or above.

- The account holder can transfer & receive funds using NEFT. At the same time, the non-customers also can deposit cash at the NEFT up to Rs. 50, 000/- per transaction.

- Using NEFT system is a safe, simple, fastest and secure way of transferring money online.

- The NEFT-enabled banks alone can transfer & receive money online.

- The remitter should have the necessary details like beneficiary name, account number and account type, name and IFSC code of the bank branch.

- IFSC Code: Indian Financial System Code (IFSC) is an alpha-numeric code that uniquely identifies a bank-branch participating in the NEFT system. This code is of 11 digit code.

- Usually, IFSC code will be printed on the cheque books, OR it may be obtained from the branch where the account is maintained as directed by RBI. (IFSC codes will also be available on the website of RBI.)

RTGS:

- RTGS stands for Real Time Gross Settlement, Using RTGS one can transfer fund from one account to another in real time.

- The ‘Real time’ denotes that the transactions complete immediately as soon as they are processed.

- Minimum amount – Rs. 2,00,000.

- Maximum amount – No limit.

Few Other Important Banking Terms

1. What is a Linked Account?

An account that is linked to your account for the purpose of fund transfer is called a linked account.

2. What is Base Rate?

This is the minimum rate at which a bank can lend to its customers. It cannot lend below the base rate. All interest rates determined for various loans will use the base rate as the benchmark.

3. What is Balance Transfer?

This is a credit card payment option for people using more than one credit card. Like the name suggests, balance transfer is when you transfer the balance of one credit card to another. This is useful when a card holder is unable to make full payment on his/her card, or if the second credit card offers a lesser rate of interest.

4. What is Credit History?

Credit history is the past behavioural patterns of a customer with regard to loans. A credit bureau will collect the information of a customer and then translate it to a number between 300 and 900. This is known as your credit score and the higher the credit score, the better your chances are to avail a loan or a credit card.

5. What is Collateral?

Any security provided to the bank in exchange for a loan is known as collateral. A collateral can be in the form of land, gold, etc. This is called a secured loan and is less risky than an unsecured loan for the lender. In case of secured loans, the lender may auction off the collateral if the borrower fails to pay off his/her loan.

6. What is Documentation Fee?

Before lending money, lenders have to gauge the credit worthiness of a customer. Customers will usually be charged for this service, also known as documentation fee.

7. What is Fixed Rate?

A fixed rate is when the rate of interest for a loan remains constant throughout the entire tenure.

8. What is Floating Rate?

Opposite of fixed rate, a floating rate of interest are interest rates that change during the tenure of the loan. These interest rates change as per the changes of interest rates in the economy.

9. What is MICR Code?

This is a nine-digit code found in the bottom right hand corner of a cheque leaf. This code varies from bank to bank and is an acronym for Magnetic Ink Character Recognition.

10. What is Electronic Clearing Service?

This is a technology used by banks wherein a certain amount of money is directly debited from your account on a specified date every month towards the payment of a loan, mutual fund account, etc.

11. What is NEFT?

NEFT (National Electronic Funds Transfer) is an electronic means to transfer money from one bank to another or within the same branch. Depending on the bank, NEFT charges and the minimum amount that can be transferred may vary.

12. What is Processing Fee?

In order to process a loan application of a customer, banks usually charge a fee. This fee is known as a processing fee.

13. What is APR?

Annual Percentage Rate (APR) is the yearly interest you earn by depositing your money your money into an account. This does not take into consideration the compound interest.

14. What is Compound Interest?

Simple interest is the interest earned on a deposit. Compound interest is the interest earned on the deposit plus the interest earned on the same deposit previously. For example, if you’ve deposited Rs.1 lakh into a bank, and the bank promises to pay you a 10% interest, you will earn an interest of Rs.1000. The next year however, you will be receiving an interest on Rs.1, 10, 000, i.e., the initial amount deposited plus the interest earned on that amount.

15. What is Returned Item Fee?

In case a cheque has bounced due to insufficient funds or another reason, the account holder will be penalized with a fee. This fee is called returned item fee.

16. What is Overdraft Fee?

In the event, that you run out of money in your account, certain banks under certain schemes allow you to withdraw more money than you have in your account. This is a loan, in a sense, and the bank will charge you a fee on repayment. This fee is called overdraft fee.

17. What is Liquidity?

The ability to sell an asset in the market without affecting its price is called liquidity.

18. What is Monetary Policies?

This refers to the rules and regulations that the Reserve Bank of India have put in place in order to standardize banking procedures in the nation.

19. What is Statutory Liquidity Ratio (SLR)?

The minimum reserve required by the bank to maintain in the form of gold is called statutory liquidity ratio.

20. What is Capital Gain?

This is a profit or gain attained by a bank by sale of investments or properties.

You need to consider a lot of factors when you are thinking of switching to a cloud account software for your small business, let us help you make this decision.

Thinking why choose Xebra over multiple other softwares like tally? Read this short article to know more.

The latest generation of entrepreneurs have started using multiple cloud accounting software’s to increase their profits as well as productivity and save massive amount of time. Read more on this topic here.

This Post Has 1 Comments

Ashish Lavania Says:

20-09-22

I’ve been surfing on the web for more than 3 hours today, yet I never found any stunning article like yours. It’s alluringly worth it for me. As I would see it, if all web proprietors and bloggers made puzzling substance as you did, the net will be in a general sense more beneficial than at whatever point in late memory.

Leave a Reply