Get input tax credit on time

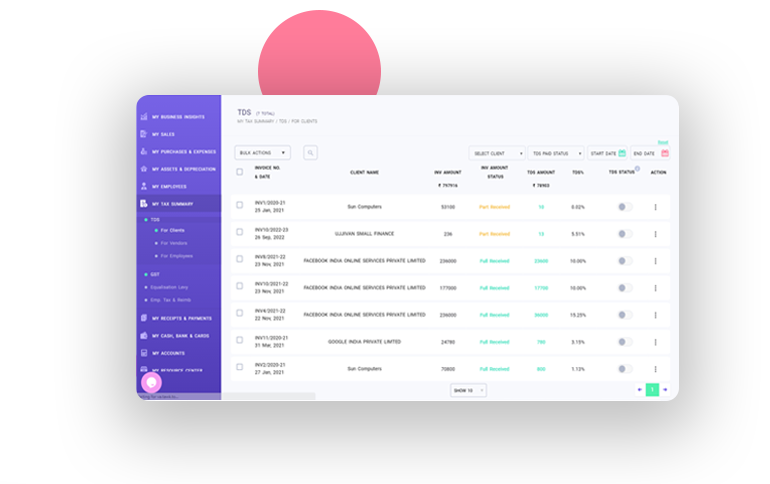

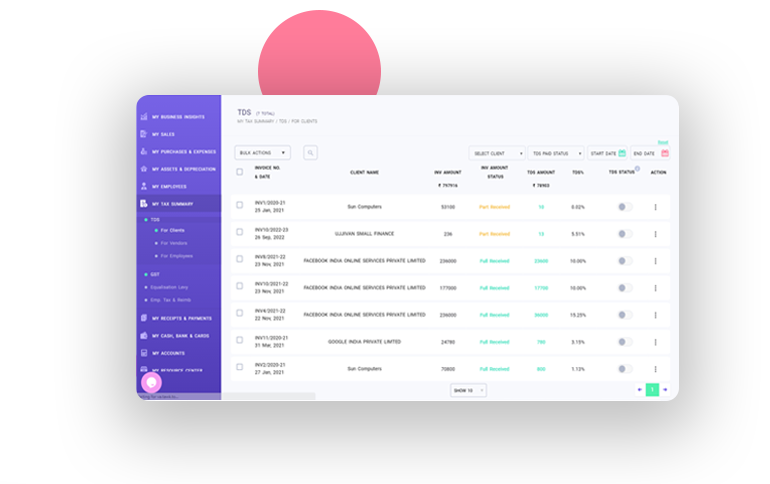

Track & record the TDS deducted by a client to map with 26AS

Identify delayed payment of clients to gain timely tax credit

Reduces payouts by a reconciliation of taxes

Reduce monthly tax payouts with our integrated TDS suite, which tracks the TDS payments. Also, save penalty money with timely alerts on your tax payments

Track & record the TDS deducted by a client to map with 26AS

Identify delayed payment of clients to gain timely tax credit

Reduces payouts by a reconciliation of taxes

Automatically calculates & records the TDS against each expense

Make faster payment records with real-time sync with accounting books

Monitor and make payment of TDS for your vendors. Avoid penalties

Auto calculates and records TDS for all employees

Record payments with a single click

Auto-generates tax compliance documents for all employees

Auto-calculates and records TDS on asset purchase

Record TDS asset payments with a click

Never pay the penalty with TDS Asset payment alerts

Timely reminders for monthly and quarterly payouts to avoid penalties

Let your clients and vendors track TDS and TCS status from a separate portal

Know the status of your TDS payment for your company

Easily export data into excel or email to clients

Upload TDS challan copies for future reference