Automatic GST Calculation Module

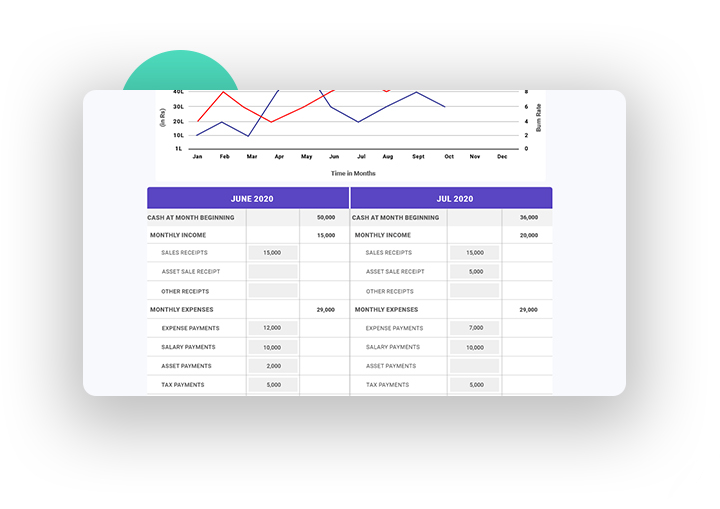

Get complete GSTR1 sales & credit notes reports with a click

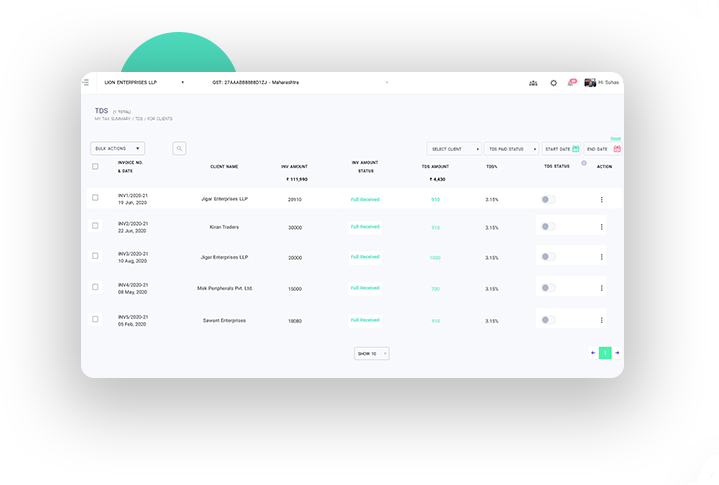

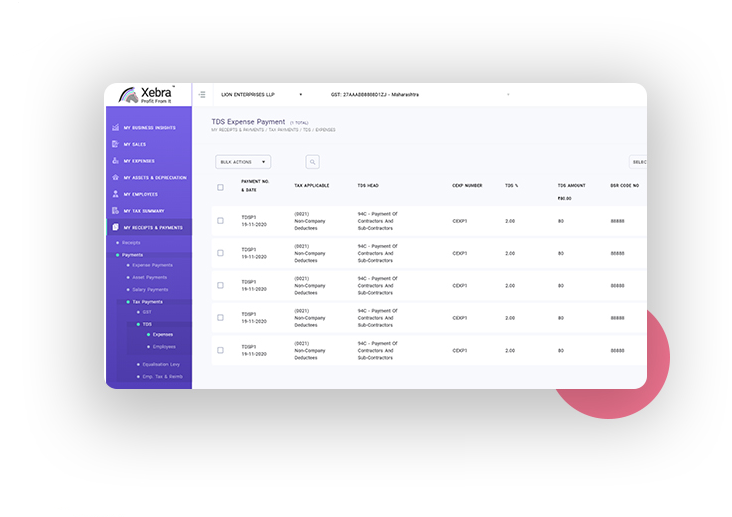

In case of multiple GSTIN in your company, select the one from the top bar and track GSTIN wise tax payments

GST calculation table to factor in input credit